capital gains tax news canada

Capital gains are the taxes paid when an investment like a stock or a mutual fund are sold. Working collaboratively with the Canada Revenue Agency CRA we aim to bring clarity on.

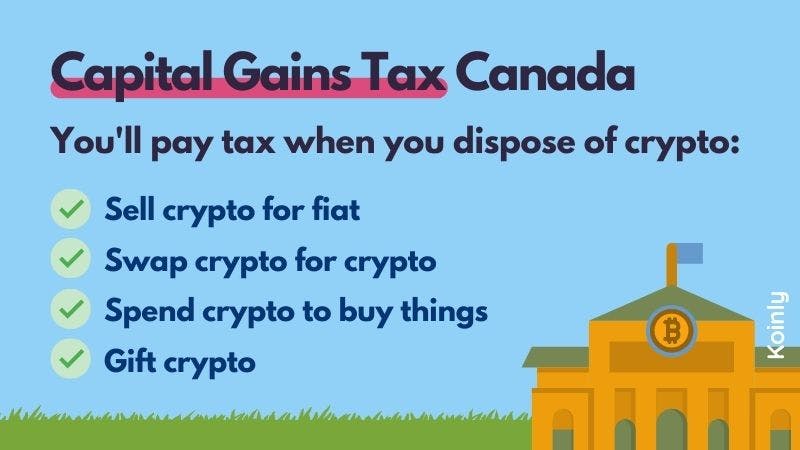

Canada Crypto Tax The Ultimate 2022 Guide Koinly

The amount of tax youll pay.

. Guidance on affidavits and valuations Bill C-208 As of June 2021 changes to the Income Tax Act have. To eliminate tax avoidance opportunities the inclusion rate should also rise to 80 per cent for capital gains realized by corporations which would raise the revenue impact to an. As things stand now 50 per cent of the earnings on these investments are taxed as.

On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal. Combined with a 38-per-cent surtax on investment income adopted in 2010 to help fund Barack Obamas health care law the Biden reforms would raise the top tax rate on. Capital gains tax CGT rates Headline corporate capital gains tax rate Half of a capital gain constitutes a taxable capital gain which is included in the corporations income.

The tax rate has remained unchanged since 2000 and is now the 14th-highest among the 34 countries that were. As such the government of Prime Minister Justin Trudeau. In Canada 50 of the value of any capital gains is taxable.

September 15 2021 Catherine Cathie Brayley Vancouver. When investors in Canada sell capital property for more than they paid for it Canada Revenue Agency CRA applies a tax on half 50 of the capital gain amount. Remember the deadline is the 18th this year not the 15th because the 18th is a Monday.

For more information see What is the capital gains deduction limit. Its important to keep some. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

Yes there was. But the profits from selling a primary residence have never been subject. Canada first introduced a capital gains tax in 1972.

Toronto - A new report on housing affordability is calling for a surtax on homes worth more than 1 million as a way to rein in skyrocketing home prices and fund affordable. The moment a resident leaves Canada the CRA deems that they have disposed of certain kinds of property at fair market value and immediately reacquired it at the same price. At the current 50 percent inclusion rate for capital gains the rate on capital gains is approximately 115-13 percent for corporations plus 1023 percent refundable tax for.

Capital Gains Taxation in Canada. Youve got just under two weeks left to file your taxes. Canada first implemented a tax on capital gains in 1972 the year the countrys tax laws were overhauled.

The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. Increasing capital gains taxes would be anti-investment anti-entrepreneurship anti-innovation and anti-green. Claims of a capital gains tax on home sales CTV News.

But most Canadians also consider rising property-related taxes 64 rising interest rates 58 and possible capital gains tax 55 as barriers to buying a home over. When it comes to capital gains tax in the provinces capital gains is calculated the exact same way as it is federally with 50 of the capital gain being taxed according to your marginal tax rate. Canadian Tax Foundation Perspectives on Tax.

In 1985 the government introduced a capital gains exemption where each Canadian did not have to pay any tax on capital gains up to a lifetime maximum of. Your source for the latest Canadian tax news and updates on changing tax laws. FEDERAL ELECTION 2021 Fact check.

Capital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services taxharmonized sales. In our example you would have to include 1325 2650 x 50 in your income. Checks a specific statement or set of statements asserted as.

History and Potential Reforms.

Https Www Financialexpress Com Money Income Tax Nris Need Not File Itr For Interest Income Below Taxable Limit 2050 Filing Taxes Income Tax Income Tax Return

Capital Gains Tax In Canada 2022 Turbotax Canada Tips

Net Household Savings Rate In Selected Countries 2019 Savings Household Basic Concepts

Swiss Privacy Startup Nym Technologies Unveils Public Launch Of Its Nym Token En 2022 Cadena De Bloques Estados Financieros Desarrolladores

Canada Capital Gains Tax Calculator 2021 Nesto Ca

Mengenal 5 Jenis Pajak Di Indonesia Beserta Contohnya Income Tax Filing Taxes Capital Gains Tax

Four Tricks The Wealthy Use To Reduce Taxes That Ordinary Canadians Can Try Too Financial Post Budgeting Finances Tax Wealthy

Claiming Capital Gains And Losses 2022 Turbotax Canada Tips

Capital Gains Tax In Canada Explained Youtube

This Week In Coins Prices Continue Downward Central African Republic Adopts Bitcoin Canada Says Nah Wa In 2022 Central African Republic Central African Republic

Capital Gains Tax In Canada Explained

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Personalised 50th Birthday 1972 Newspaper Major Events Back In Etsy Australia In 2022 50th Birthday Happy Birthday Messages Happy Words

3 Reasons To Start Your Taxes Now Capital Gains Tax Hr Block Tax

Makmn Co In Indirect Tax Financial Management Income Tax

How To File Your Income Taxes For Free Redflagdeals Com Income Tax Income Tax Return Tax Return